Fixed income investments, commonly known as bonds, are a fundamental component of portfolios, offering investors regular income, diversification, and risk mitigation.

Schroders' fixed income guide provides a comprehensive introduction from what they are, the benefits, risks, and common types. Below, we’ve summarised the key highlights for you:

What are bonds?

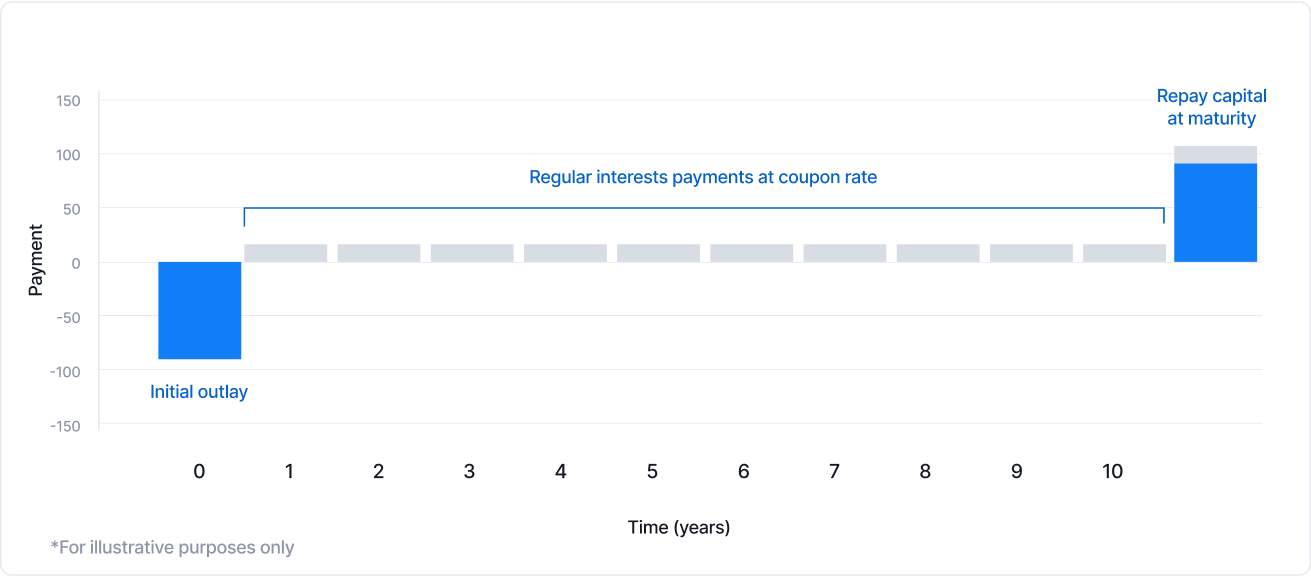

Bonds are essentially loans made by investors to entities such as governments or corporations. In return, these issuers commit to:

1. Repaying the principal amount at a predetermined maturity date.

2. Providing regular interest payments, known as coupons, throughout the bond's term.

The rate of these coupons is influenced by factors like prevailing economic conditions, the investment timeframe, and the issuer's creditworthiness.

Benefits of fixed income investing

Bond mechanics

Bonds can vary in structure:

· Fixed-Rate Bonds: Offer fixed interest payments throughout their term.

· Floating-Rate Bonds: Have variable interest rates, often tied to benchmarks like the Singapore Overnight Rate Average (SORA) and the Secured Overnight Financing Rate (SOFR) in the US.

· Zero-Coupon Bonds: Sold at a discount and pay no periodic interest, but returns the full face value at maturity.

Coupons are one component of the total returns when investing in bonds – the other source is capital gain. Bond prices and yields have an inverse relationship. When interest rates rise, existing bond prices typically fall, and vice versa. This dynamic is crucial for investors to understand, especially in fluctuating interest rate environments.

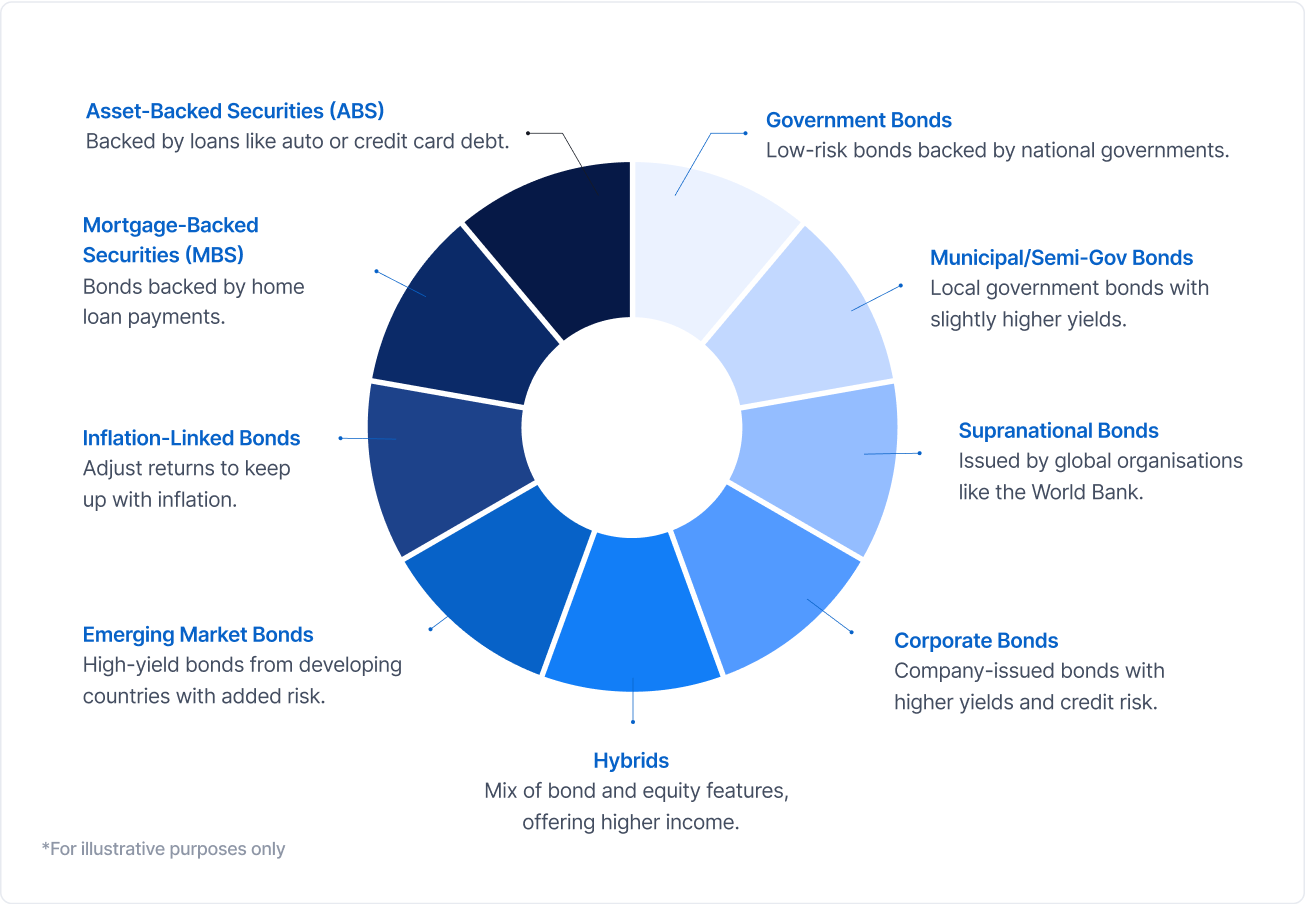

Common types of bonds

The global bond universe is large and diverse. Below are some common types:

Investing in bond funds

Bond funds are a simple and accessible way to start fixed income investing, offering several advantages over buying individual bonds:

Lower investment minimums:

While buying a single bond may require SGD 250,000 or more, bond funds typically allow entry from as low as SGD 1,000.

Diversification:

Bond funds spread your investment across multiple issuers, regions, and sectors—reducing the impact of any single default.

Greater access:

Investors gain exposure to a broader range of bonds that are carefully selected for a diversified portfolio that would otherwise be out of reach.

Liquidity:

Unlike individual bonds, bond funds can typically be redeemed anytime, offering flexibility.

Professional management:

Experienced managers actively manage the portfolio’s bond selection, duration, and credit quality to adapt to market conditions and optimise returns.

Key risks involved

Interest Rate Risk (Duration Risk):

Bond prices are sensitive to interest rate changes. The longer the bond’s duration, the more its price may fluctuate with rate movements.

Credit/Default Risk:

There’s a chance the issuer may fail to make interest or principal payments. Government bonds typically carry lower default risk, while corporate and high-yield bonds are more vulnerable.

Liquidity Risk:

Some bonds may be difficult to sell quickly due to a lack of market buyers, which can result in selling at a discount. Investing in higher-quality, investment-grade bonds can help manage this risk.

For a deeper dive into fixed income investing, visit their Introduction to Fixed Income and Bonds page.

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX bear any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.